Strong

Heading into the future with confidence

Facts & figures 2018

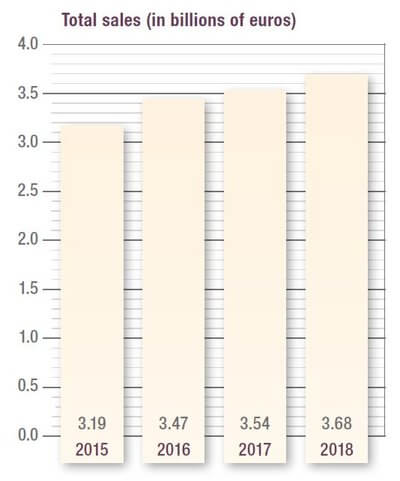

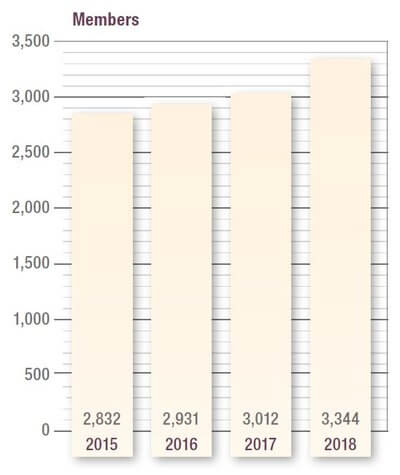

Business developments at DER KREIS The members and partners of DER KREIS buying group, who operate specialist businesses both domestically and abroad, were among the winners across all channels in 2018. This outcome is evident when we look at the numbers from DER KREIS buying group, which recorded a four-percent increase in overall sales. I would like to thank everyone who played a part in this success, especially all of our member companies, industry partners, service providers, and staff. Once again, we can see that the services developed in cooperation with our members are well received and they help specialists with their marketing efforts. One example that I would like to highlight is our digital end customer brand “kitchen specialists”, which has successfully established a market presence in various European countries.

We can expect to see steady demand within the domestic kitchen segment in 2019, despite the slight downward correction from our expert council. Rising net incomes, a low unemployment rate, strong growth in the construction industry and slightly positive consumption trends are certainly good prerequisites for this demand. Even after the completing first months of this year, we continue to expect moderate growth in our performance on a yearly basis.

We wish you all the best of luck and look forward to our ongoing cooperation.

Best regards,

Ernst-Martin Schaible

Review of 2018: The development of DER KREIS

The work of DER KREIS buying and service group focuses on supporting and promoting small and

medium-sized enterprises in the areas of kitchen, bathroom, carpentry and interior construction in

Germany and 16 other countries. Our mission is to cooperate with our members by implementing

forward thinking product policies and by continuously developing diverse business models that will

pave the way for a successful future. In the current financial year and in 2018, the overall market has

proven to be supportive across all segments.

From the kitchen ...

The kitchen segment, and specifically the kitchen furniture sector, can look back at positive results from 2018 based on growing demand domestically and especially from abroad. This development has led the export ratio within the kitchen furniture industry to reach 40.5 percent. Part of this growth is, however, merely due to redistribution effects on the market. At the beginning of the year, these effects led many manufacturers to face order surpluses from the previous year as well as a steady flow of new orders.

Over the course of the year, domestic growth in the kitchen segment lost some of its steam. The causes for this included unusually prolonged periods of high temperatures that led to decreased order rates for kitchen retail. Additionally, domestic demand for kitchen furniture was primarily attributed to the new construction business in 2018. Demand for existing kitchen replacements during home renovation work stagnated.

Growth in the price segments for kitchens was very uneven: The classic entry-level segment and kitchens costing up to 10.000 euros saw losses while demand for the segment over 10.000 euros experienced a noticeable increase. Fortunately, average prices underwent positive development across all sales channels. Based on the ongoing trend for trading-up, the average consumer price for a kitchen, including electric appliances, increased to 7.106 euros, while the average price per kitchen sold by DER KREIS kitchen specialists rose to over 13.000 euros.

... through the bathroom ...

According to an estimate by ifo, the German Sanitary Industry Association (VDS) reported a 3.3 percent increase in sales, reaching a total of 24.9 billion euros. Encouraging signs were also once again reported by current market research with the prognosis that 9 million home-owners in Germany plan on performing (larger-scale) renovation work by 2020. The main motivating factors for this are said to be improved quality of life and comfort (80 percent), visual upgrades (75 percent) and value conservation/growth (73 percent). Among the respondents, 49 percent also cited barrierfree

and age-appropriate renovations as another factor – up by eight percentage points compared to the previous year.

In the amenities area, the bathroom continued to hold its leading position as the favoured area for investment (38 percent), as was the case two years ago. These were the results

of a survey that once again prove the high relevance of the bathroom for individual quality of life among respondents. According to prognoses from the ifo Institute, the sanitary sector is expected to see a three-percent increase in sales for 2019, up to a total of 25.6 million euros.

... all the way to personalized interior architecture

Carpentry is one of the most diverse trades that exists and carpenters are the experts when it comes to building, living and furnishing. This segment involves the manufacture of customized furniture as well as the design and execution of complete interiors. Through the highly efficient combination of traditional trade activities and computer-controlled machines, modern carpentry workshops work with both wood and other materials that many carpenters use to construct trade fair stands, shop fittings and concert halls. The majority of businesses work with furniture-making and interior construction. They manufacture whatever it is that the customer desires. There are, however, also businesses that choose to specialize in a certain area. This can include shop fitting, window construction, hospital furnishings or even kitchens.